Annual after tax income calculator

This places Ireland on the 8th place in the International. With five working days in a week this means that you are working 40 hours per week.

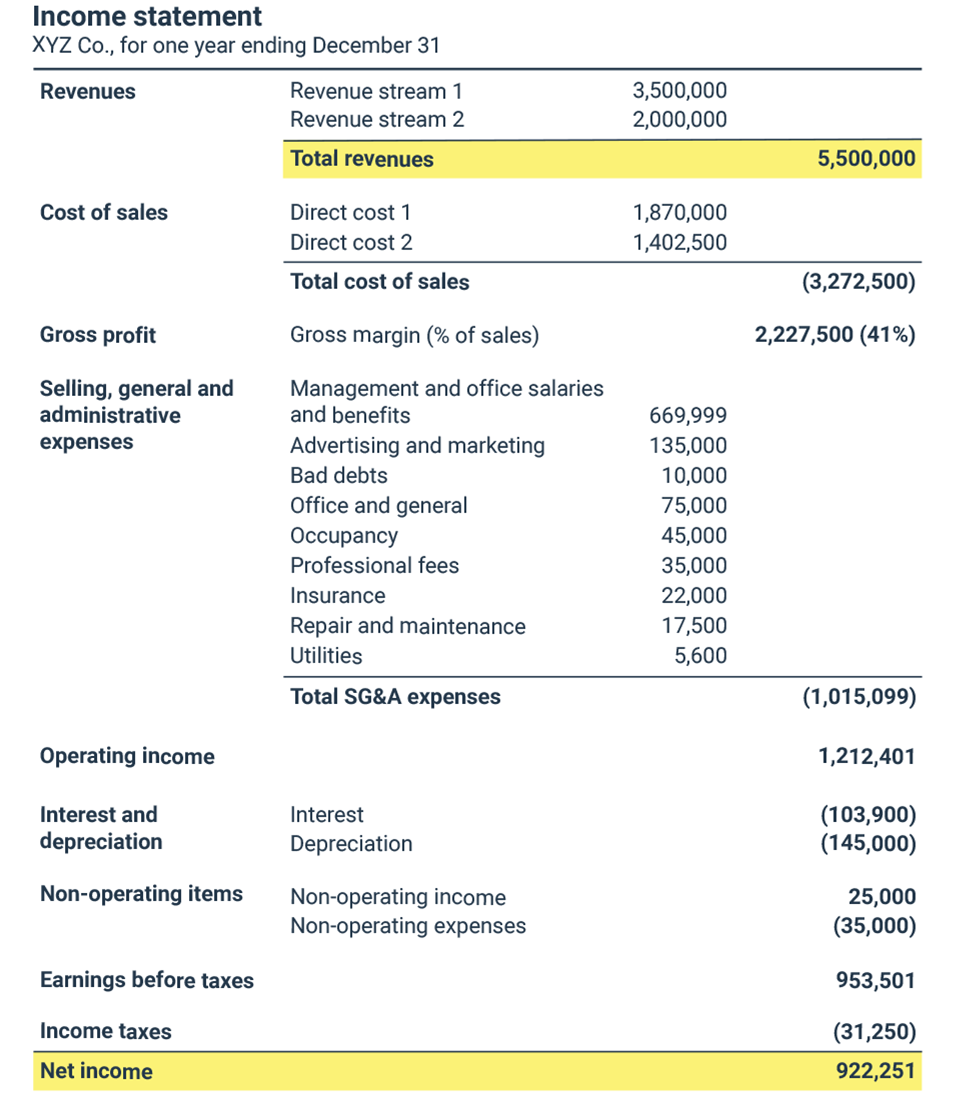

How To Calculate Net Income Formula And Examples Bench Accounting

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. Read reviews on the premier Paycheck Tools in the industry. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

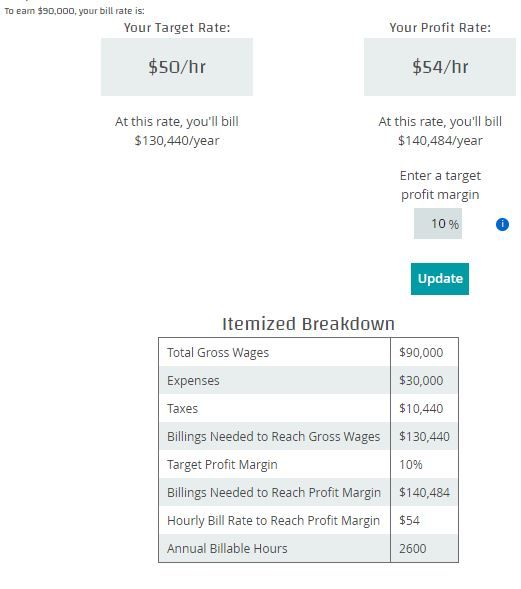

Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. If your employer pays you by the hour multiply your hourly wage by the number of hours your work each week. Your marginal tax rate.

It is mainly intended for residents of the US. Using the annual income formula the calculation would be. If you make 55000 a year living in the region of New York USA you will be taxed 11959.

Ad See the Paycheck Tools your competitors are already using - Start Now. Our Resources Can Help You Decide Between Taxable Vs. Annual Income 15hour x 40 hoursweek x.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. That means that your net pay will be 45925 per year or 3827 per month. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare.

Use this calculator to see how inflation will change your pay in real terms. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The Annual Tax Calculator is our most comprehensive UK payroll tax calculator with features for calculating salary PAYE Income Tax Employee National Insurance Employers National.

To calculate the after-tax income simply subtract total taxes from the gross income. Use our free income tax calculator to work out how much tax you should be paying in Australia. The formula for after-tax income is quite simple as given below.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. Your income after tax Medicare levy. Your average tax rate is.

That means that your net pay will be 37957 per year or 3163 per month. The average monthly net salary in the Republic of Ireland is around 3000 EUR with a minimum income of 177450 EUR per month. Determine your annual salary.

100 Accurate Calculations Guaranteed. Your average tax rate is. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

That means that your net pay will be 43041 per year or 3587 per month. Financial Facts About the US. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

Then multiply it by 52. Your average tax rate is. If you make 55000 a year living in the region of Texas USA you will be taxed 9076.

Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today. This places US on the 4th place out of. And is based on the tax brackets of 2021 and.

The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month. Your employer withholds a 62 Social Security tax and a. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

This means for an annual. It can also be used to help fill steps 3 and 4 of a W-4 form. Input the date of you last pay rise when your current pay was set and find out where your current salary has.

That means that your net pay will be 40568 per year or 3381 per month. Ad Try Our Free And Simple Tax Refund Calculator.

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

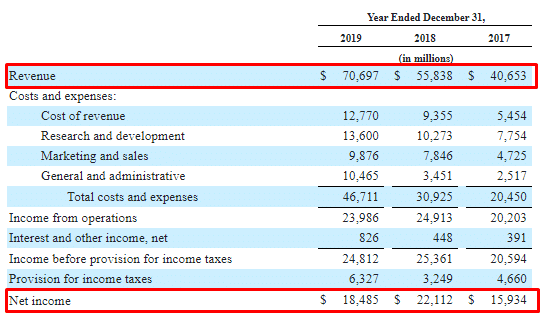

What Are Earnings After Tax Bdc Ca

How To Calculate Income Tax In Excel

Taxable Income Formula Examples How To Calculate Taxable Income

Annual Income Calculator

2021 2022 Income Tax Calculator Canada Wowa Ca

Calculating Income Tax Payable Youtube

How To Calculate Income Tax In Excel

Net Profit Margin Calculator Bdc Ca

Excel Formula Income Tax Bracket Calculation Exceljet

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net Income After Taxes Niat

Profit After Tax Definition Formula How To Calculate Net Profit After Tax

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Examples How To Calculate Taxable Income

Gross Vs Net Income Key Differences How To Calculate Mbo Partners

What Is Net Income Definition Formula And How To Calculate Stock Analysis