How much can i borrow for shared ownership

The amount you can provide as a deposit Your household income. You can also input your spouses income if you intend to obtain a joint application for the mortgage.

A Guide To The Government S Help To Buy Schemes Foxtons

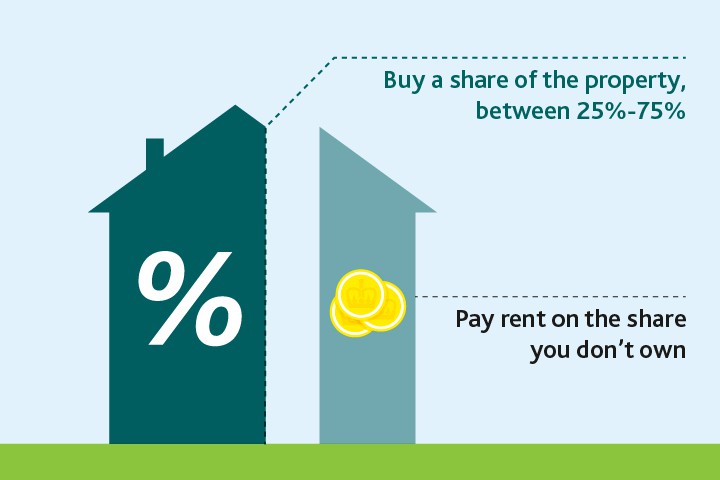

You only pay a mortgage and deposit on the share you own.

. This guide sets out how the scheme works in England who can take part and. Joint mortgages are usually shared by two people but some lenders will allow up to four borrowers. You will need to then arrange your own mortgage with the bank.

Under the shared ownership program you can purchase a share of your home and pay rent on the remaining mortgage. This form of ownership allows a franchisee to borrow the franchisors business model and brand for a specified period. Ideally this message should be a one sentence summary with a link to an issue to allow for a single source of truth for any feedback.

When the time comes for you to progress to the Shared Ownership programme we will assist you by introducing you to the banks that we work with and who approve our shared ownership programmes. Under shared ownership you can buy either 25 50 or 75 of a property in Scotland with a housing association to which youll pay a reduced rent on the proportion you dont own. Jasons a committed member-first problem solver who cant wait to help make your next home or refi happen and he loves working at Wisconsins 1 mortgage lender.

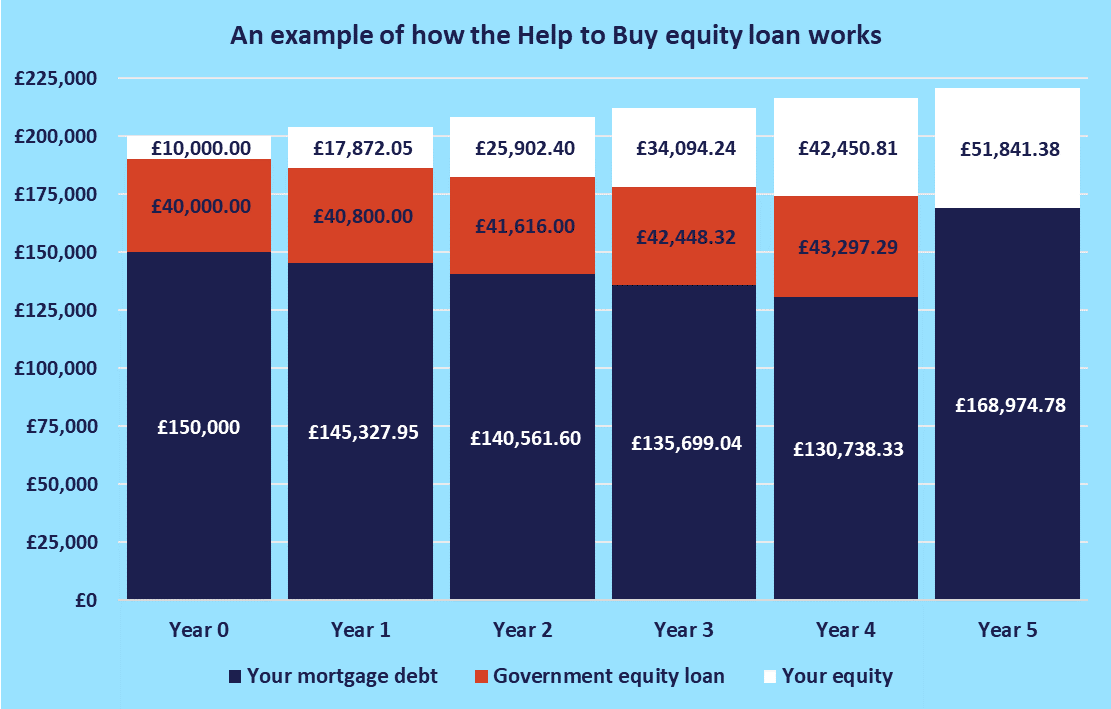

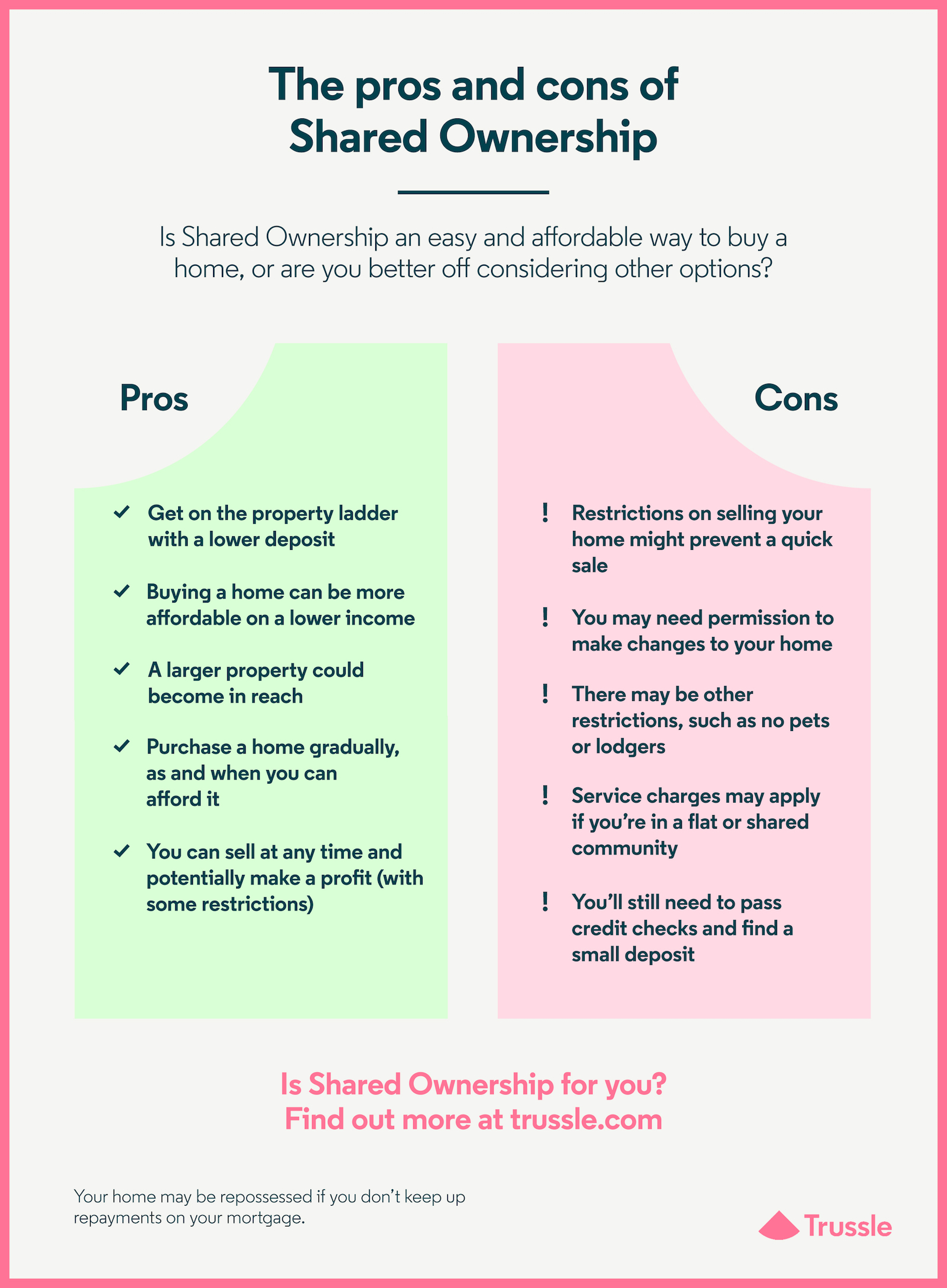

This loan is repaid either on the sale of the property or the end of the mortgage term whichever comes first. Youll need to spend a little longer on this. Buying part of a property through shared ownership is one way of getting a foot on that first rung of the ladder a ladder thats become harder to climb as property prices continue to soar.

You buy a share usually 25-75. Money you owe because of loans credit cards or other commitments. If you have a new shared ownership lease then you can.

Start online or you can call 1300 578 278 to chat with our team. This is a fee charged by a surveying company to check property lines and shared fences to confirm a propertys boundaries. And dont forget youll need to arrange a Buy to Let mortgage if youre planning to rent out a property.

Remember it provides only an indication. You buy a share usually 25-75. Yet while the concept of shared ownership is straightforward in practice it can be both complicated and expensive.

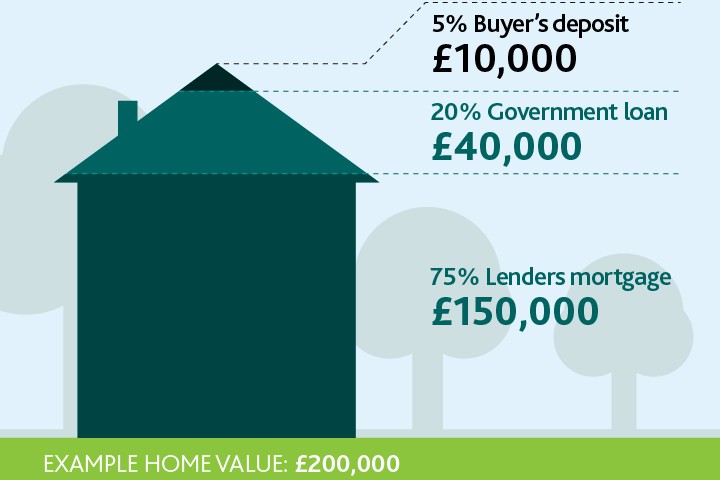

First-time homebuyers who meet affordability and lending terms can borrow an equity loan of up to 20 40 in London of the sale price of. Jasons spent much of his professional life at Summit. A timeshare also known as a vacation ownership is a lifetime commitment to paying for annual trips to the same resort or family of resorts.

Co-ownership Northern Ireland. What if we cant afford mortgage payments after 5 years. Shared ownership Scotland.

If you frequently check any of these channels you can consider yourself informed. You can use the above calculator to estimate how much you can borrow based on your salary. Note this is for flexible shared ownership home loans properties only fixed shared ownership loans can only be sold back to the Housing Authority.

Find out how much you can borrow - so youll know how much you can afford before you put in an offer. Help to Buy Shared Ownership. You pay rent on the rest.

Our mortgage calculator can give you an idea of how much you might be able to borrow. If youre more ambitious and can figure out how to pull in an extra 20k per year on the side after tax and invest it at 8 per year youll have 430000 in extra money in 15 years. Shared Ownership just with a non-branded name.

The amount you are able to borrow will help you determine the size of the further share you are. It comes with a list of advantages including. Get a quick quote for how much you could borrow for a property youll live in based on your financial situation.

You can use our rental mortgage calculator to get an idea of how much you can borrow then get in touch with our expert advisers for fee free expert mortgage advice. With a Shared Equity mortgage youll receive an equity loan which well treat as part of your deposit. Shared ownership what were referring to on this website The same as Help to Buy.

It is generally between 300 and 500 though it can be higher if the. You prepay or finance a lump sum upfront plus annual. Well support you at every step of the way from finding the best.

According to the Office of National Statistics in December 2020 the average house price in the UK was 252000. Staircase in 1 tranches for the first 15 years of the lease. On that amount a 5 deposit is 12600 and a 15 deposit is 37800.

Whether youre buying alone or with someone else. If you want a more accurate quote use our affordability calculator. Small or medium side gigs can seriously put you in the top 5 of people by wealth over time.

We dont currently offer Shared Equity schemes online so please either give us a call or visit us in branch. Shared ownership is a type of mortgage. Thats where shared ownership mortgages can help.

In the future if you wish you can usually buy further shares until you own your home outright. Shared Ownership provides an affordable way to buy a property. Simply purchase a share in a brand-new home and pay a subsidised rent on the remaining.

Training on how to operate your franchise systems and technologies for day-to-day operations guidance on marketing advertising and other business needs and a network of. If youre a first time buyer saving a big deposit can be tricky. If you own a property as joint tenants you can change your type of ownership to become tenants in common - known as severing a.

For non-homeowners unable to afford to buy housing association homes on the open market. Because lenders will consider the combined incomes of two applicants when assessing how much you can borrow. It is up to the person sharing to ensure that the same message is shared across all channels.

Youll pay a mortgage on your share then pay rent on the rest. Equity Loan 2021-23 England. Because he believes in doing right by everyone whose path he crosses and knows Summit does too.

Its different to a residential mortgage as instead of buying the whole property you buy a share. Staircase in 5 increments.

Ultimate First Time Buyer Guide How Much Money Do You Need To Buy A House

How To Increase The Amount You Can Borrow My Simple Mortgage

How Much Of A Deposit Do You Need For Shared Ownership Mortgage Light

:max_bytes(150000):strip_icc():gifv()/ESOP_Final_4196964-5ef6212f097d4105823ebe8b6591b5c3.png)

Employee Stock Ownership Plan Esop What It Is How It Works Advantages

Shared Ownership Is It Right For You Barclays

Shared Ownership Mortgages September 2022 Forbes Advisor Uk

Shared Ownership Mortgages Just Mortgage Brokers

How Much Of A Deposit Do You Need For Shared Ownership Mortgage Light

We Re Selling A Shared Ownership Home What Is A Fair Price Property The Guardian

Shared Ownership Mortgages Explained Nerdwallet Uk

:max_bytes(150000):strip_icc()/why-would-company-buyback-its-own-shares_FINAL-dc32eefe564647ce9c66c345230fd0a9.png)

Stock Buybacks Why Do Companies Buy Back Shares

Can I Get A Shared Ownership Mortgage With Bad Credit Haysto

Considerations For Shared Ownership Of Family Property

A Guide To The Government S Help To Buy Schemes Foxtons

Help To Buy And Shared Ownership What You Need To Know About First Time Buyer Schemes In London

/ESOP_Final_4196964-5ef6212f097d4105823ebe8b6591b5c3.png)

Employee Stock Ownership Plan Esop What It Is How It Works Advantages

Shared Ownership Guide Trussle